texas property tax lenders

Well help you make an informed decision about property tax loans and show what Tax Ease can do. Chapter 342 Texas Finance Code.

Texas Property Tax Loans Residential Commercial Hunter Kelsey

Use Our Comparison Site Find Out Which Mortgage Lender Suits You The Best.

. Since 2007 Propel Tax has made over 600M in property tax loans across Texas. We will pay your property taxes now you can pay us back over time. Transfer Existing License Application.

No Cost No Obligation. OConnor Associates is the largest Property tax Consultant firm in Texas. Regulated consumer loans are made at rates of interest greater than 10.

Property Tax Funding is a Texas based company that offers an alternative to the lump sum payment of property taxes. Call Today For Your Free Quote 800 688-7306 800 688-7306. Contact the OCCC to ask them about the company you are considering at 1-800-538-1579 or visit their web site at wwwocccstatetxus to verify that the company is.

We service our own loans so that the process is quick. With nearly 20 years of experience in the industry Tax Ease employs the best Texas property tax lenders in the state to assist with substantial tax bills and delinquent fees. Our goal is to help more people breathe easier at tax.

Apply for a loan with Texas Property Tax Loans here. The lender receives a superior tax lien allowing it to foreclose on the property if the loan is not repaid on time. Enter Zip - Get Qualified Instantly.

Get Pricing Calculate Savings. Stated Income Make Sense Underwriting Fast Close. Reach Out to The Texas Property Tax Lenders at Tax Ease.

Save Time Money. A Texas-based alliance of companies landowners and partners that advance and protect the profession of property tax lending to help Texas property owners. Ad When Banks Say No We Say Yes.

Ad OConnor Associates is the largest Property tax Consultant in Texas. The goal of the TPTLA is to raise awareness of property tax loans and promote high standards of behavior among its. The license transfer checklist can be found here.

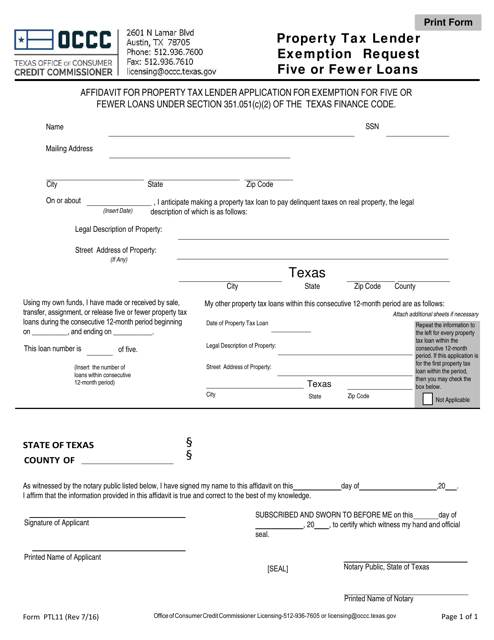

This office requires minimum standards of capitalization professionalism and official licensing for property tax lenders. A property tax lender makes loans to property owners to pay delinquent or due property taxes. In the case of mortgaged property where taxes are paid from an.

We always look for reputable property tax lenders to add to our Texass vendor list. Need a Texas Property Tax Loans. 1 a reasonable fee for filing the release of a tax lien authorized under Section 3206.

A The contract between a property tax lender and a property owner may require the property owner to pay the following costs after closing. Ad Find Top Rated Solar Companies in Your Area. A property tax loan from Property Tax Funding will immediately pay off all taxes owed on your property including penalties interest and even court costs.

See why over 50000 Texans have relied on us for help with property taxes. We service our own loans so that the process is quick. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

We help Texans pay their residential and commercial property taxes. Apply for a loan with Texas Property Tax Loans here. 1 or as soon thereafter as practicable each year.

Non-depository lenders who engage in making transacting or collecting loans with a rate of interest greater than 10 must be licensed by the OCCC. A Hunter-Kelsey property tax loan helps you quickly pay your taxes so youll no longer incur the large penalties interest and. When reviewing different property tax lenders Texas residents have a lot to consider.

The buyer should create a new account and initiate the process under Manage My Business. Texas Property Tax Assistance 888 743-7993 Customer Service 972 233-4929 all states. A property tax lender is a person who engages in the business.

Tax Code Section 3101 requires the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that persons agent by Oct. Learn more from the experts in Texas Property Tax Lenders about how property loans work and commonly asked questions about Texas property tax loans. Businesses wishing to complete a transfer of license can do so using ALECS.

If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential and commercial property owners in the state of Texas apply to get listed on our. Let Home Tax Solutions help you get a Property Tax Loan with No Payments for 12 Months and No Credit Check. We operate in every Texas county and can finance all types of real estate - residential commercial industrial and land.

Choose The Best Texas Property Tax Loan Provider Federal Lawyer

Hunter Kelsey Of Texas Llc Complaints Better Business Bureau Profile

Texas Property Tax Loans Learn Everything About Property Tax Loans In Texas Tax Ease

Property Tax Loan Lender Referral Loan Program

Mi Casa Financial Llc Texas Property Tax Loans In San Pedro Ave San Antonio Texas Weloans

Texas Property Tax Loans Real Estate Documents Sweed Notary Notary Public And Apostille In Euless Tx

Texas Property Tax Loan No Credit Check Loan Application

A High Price To Pay The Texas Observer

Property Tax Lenders Learn About Texas Property Tax Loans Lenders Tax Ease

Texas Property Tax Loans Help With Delinquent Property Taxes For Residental And Commercial Properties In Texas Tax Ease

Texas Property Tax Loans Johnson Starr

Home Ovation Lending Ovation Lending

Property Tax Lending Industry Under Review Again The Texas Tribune

Calameo Which Are The Advantages Of Property Tax Loans

How Do Texas Property Tax Loans Work Advance Community Fund

Small Business Property Tax Loan Ovation Lending

Basics Of Property Taxes Mortgagemark Com

Tptla Texas Property Tax Lienholders Association

Form Ptl11 Download Fillable Pdf Or Fill Online Property Tax Lender Exemption Request Five Or Fewer Loans Texas Templateroller